Table of Content

Attractive interest rates along with affordable processing fees. Last six months’ Bank Statement of overseas account in the name of individual as well as company/unit. Banks will provides you an home loan if you are eligible for home loan. Banks required below listed documents when you apply for home loan.

However, above the threshold of INR 25,000, each missed EMIs will be charged up to 2% above the interest expense. SBI Home Loan requires an individual or a group to have a minimum CIBIL score of 650 or above. Other factors also determine whether one can avail of a home loan from SBI or not. Eligible home loan amount will be based on the employer profile, property type, and repayment capacity. Mostly, the scheme is sanctioned based on the CIBIL score of the customer, although other factors also come into play.

SBI - Loans, Accounts, Cards, Investment, Deposits, Net Banking - Personal Banking

Once you accept the home loan, you have to complete the application for the SBI home loan and submit it along with the documents required. Home loan interest rates are the lowest ever in the past 15 years. With raining festival offers on home loan, currently you can avail of the best interest rate on Kotak home loan @6.40% p.a for all loan amounts.

Based on the documents, you can get instant approval on the loan. An approved copy of building plan and Registered Agreement of Development for the builder and Conveyance Deed in case of a new property. After the application has been received and reviewed, you will get a loan offer over the phone. An approved copy of the building plan and Registered Agreement of Development for the builder and Conveyance Deed - in case of a new property.

Credit Card

This is subject to change based on the eligibility criteria of the individual. We have a network of + branches, sales teams and processing centers across the country to cater to the housing loan requirements of individual customers. Please click here to locate us and contact us for your home loan requirements. Please locate us and contact us for your home loan requirements. If you want to download home loan application form, you need to go to theofficial website of SBI.

There are classes specified for which a varied interest rate is assigned. To avail of an SBI home loan offer, customers must adhere to certain parameters the bank sets. You can contact the customer care service to inform them that you have sent in the wrong document. However, it is advisable that you check your application thoroughly before submitting it to prevent it from getting rejected. Once the offer is accepted, the applicant must submit the application form with the necessary documents.

SBI FINDER

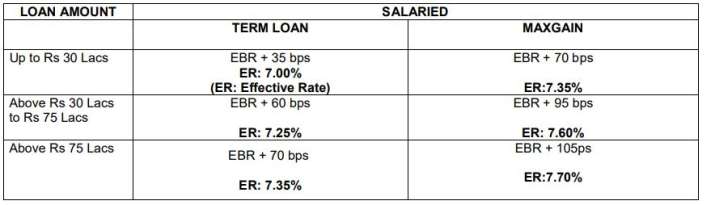

By clicking the "Proceed" button, you will be agreeing to the above. State Bank of India Home Loan Calculator helps you calculate the EMI, monthly reducing balance, and monthly interest on the basis of the loan tenure, principal amount, and interest rate. SBI is known for its highly flexible and convenient interest rates offered at home loans. Whether you are availing the home loan as a term loan or as an overdraft , the rate of interest varies a little but is highly convenient for people from all strata’s of the society. Thus, while the interest rate broadly ranges from about 6.65% - 7.5% in a term loan for people with different range of annual salaries, it ranges from about 8.35% - 8.70% if you take an overdraft.

On the homepage, you will find “Application Tracker” on the right side. If you want to download PMAY-Annexure-B form, you need to go to official website of homeloans SBI. Apart from this there are home loan takeover calculator, maxgain home loan calculator, flexipay home loan calculator, and privilege or shaurya Home Loan calculator.

Income proof can be obtained from the salary slip, or copy of form 16 or a copy of IT returns. Looking for download online application form of SBI Home Loan? SBI offers the most competitive rates for home loans and the most comprehensive financial planning advice in India. SBI is known for its conveniently low and transparent processing fee charged on its home loan. For Regular, Balance Transfer, NRI, and Fexiplay Home Loan, the processing fee is 0.35% of the loan amount plus applicable taxes. This makes it minimum amount of Rs. 2000 and maximum amount of Rs. 10,000.

Corporate Banking application to administer and manage non personal accounts online. Furthermore, with attractive SBI home loan rates, customers can be assured of getting the best deals from the institution. The table below shows the range of CIBIL scores and their respective interest rates. You can apply for an SBI home loan online directly on the SBI portal or through MyMoneyMantra. Online application is more convenient and allows faster approvals on the loan application as well.

Log in to yonobusiness.sbi to avail business banking services. Moreover, there is a provision for customers to opt for an overdraft facility and concession for women borrowers. It is always prudent to consider shopping around for the best deals banks offer. Given that many financial institutions are providing home loan products, there are always chances that one might land a better deal than the other owing to competitive market conditions. The SBI Home Loan comes with an interest rate starting from 8.50%, and other top banks offer much lesser rates. SBI offers its customers Home Loan interest rates based on the CIBIL score of each individual.

Given below are the available networks through which SBI customer care is provided. There are a few factors that act instrumental in determining the SBI home loan interest rates. Banks must be aware of the market rates, credit risk, borrowers’ repayment patterns, and other factors.

Below is a list of all the SBI Home Loan documents that one needs to submit for a Home Loan as per their employment status and other parameters. Yes, SBI offers two types of insurance along with its home loans. One is the Term Insurance by SBI Life Insurance which is a financial coverage to the term life insurance policy holder for a specific time period. The other is Property Insurance offered by SBI General covering private residence from unpredictable damages and natural disasters.

No comments:

Post a Comment